Estate Planning, Tax Reduction, And Wealth Management Workshops

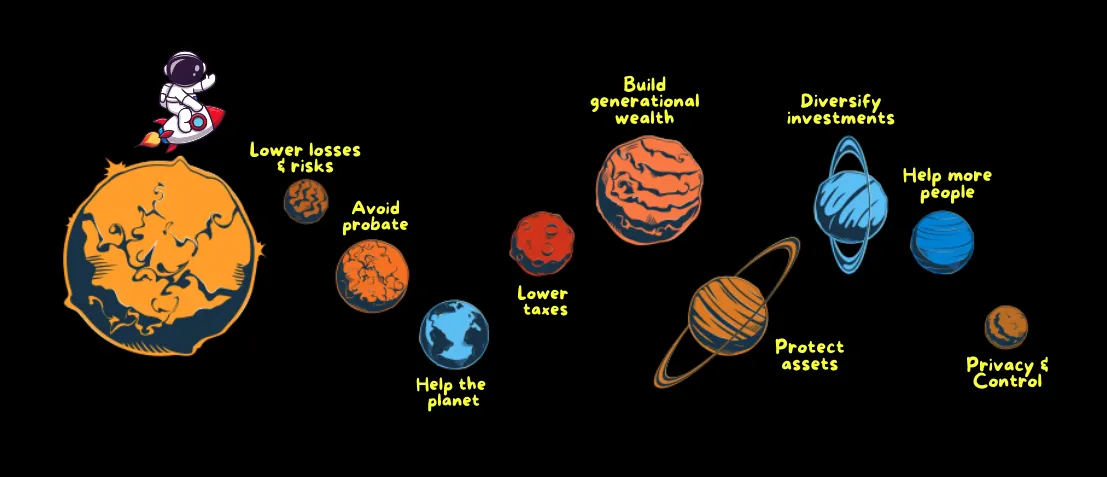

Learn How To Protect, Preserve, And Pass-On Your Assets Strategically

If Pictures Say A Thousand Words...

These are the topics what we cover during these workshops!

ESTATE PLANNING USING WILLS, TRUSTS, AND FOUNDATIONS

Discover how estate planning works and how to use wills, trusts, and foundations to strategically lower the "value" of your estate and mitigate all sorts of taxes, costs, and delays, while preserving your wealth for many generations to come.

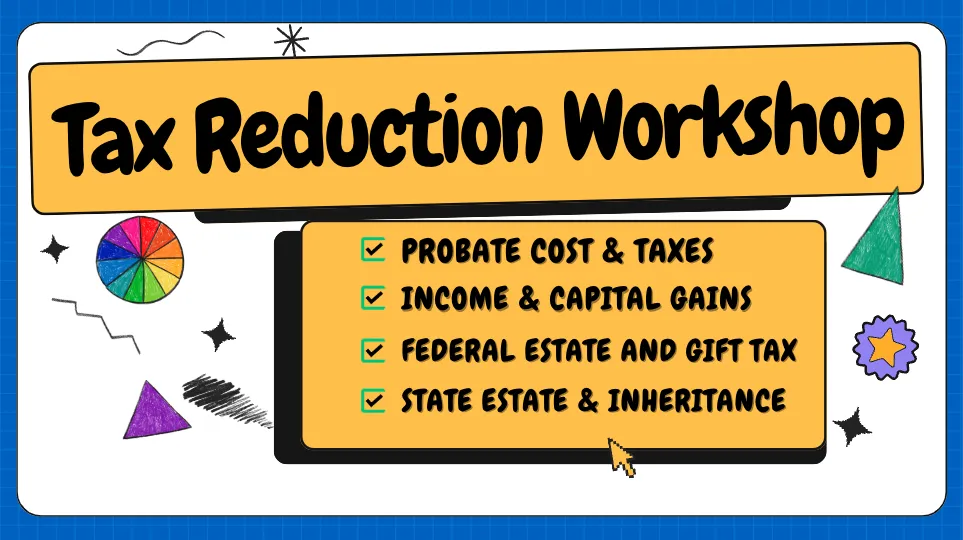

TAX REDUCTION WORKSHOP FOR ENTREPRENEURS & INVESTORS

Live and interactive tax calculation sessions using our proprietary "THE HIDDEN TAX CALCULATOR" that calculates taxes that are often forgotten, misunderstood, or more often than not, not even know to individuals or their families.

INVESTING STRATEGICALLY WITH TRUSTS AND FOUNDATIONS

Discover the world of private foundations and how corporations and families can leverage this powerful vehicle to not only reduce all sorts of taxes, but also grow wealth in a tax-exempt setting while funding charitable causes and missions.

Book a seat at the workshop to learn the following strategies:

ASSET PROTECTION STRATEGIES:

Discover how you can make your assets untouchable, unreachable, and judgement-proof against lawsuits and claims (both business and personal, tangible and intangible).

WEALTH PRESERVATION AND MANAGEMENT STRATEGIES:

Learn how to leverage different legal entities to hold, manage, build, and pass-on wealth in a manner that is efficient, economical, and highly strategic, where your assets are protected from outside AND inside parties from diluting your wealth (ex: spendthrift beneficiaries).

ENTITY RESTRUCTURING AND TAX MITIGATION STRATEGIES:

Learn how corporations, wills, trusts, and foundations can be aligned together and deployed strategically to help you lower several layers of taxes, including federal income, capital gains, gift, and estate taxes, and state-imposed income, inheritance, estate taxes, and probate costs.

INVESTING WITH TRUSTS AND PRIVATE FOUNDATIONS:

Master the world of private foundations, the ultimate "investment" vehicle that allows donors to control their assets without the burden of ownership, legally circumvent all sorts of taxes, build a tax-free investment portfolio, and use a portion of the investment fund to advance nonprofit causes and missions.

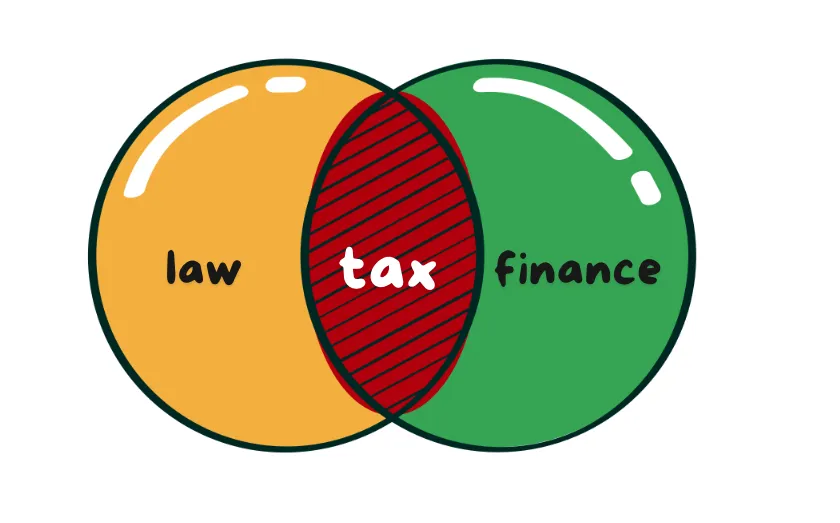

CREATING SYNERGY AND ALIGNMENT BETWEEN YOUR LEGAL, TAX, AND FINANCIAL TEAMS

Why it's important to have ALL your advisors, experts, coaches, and consultants working as ONE coherent and coordinate unit instead of "doing their own thing" without any regard to what other advisors or experts are working on.

Workshop Format: What To Expect?

WHO IS THE WORKSHOP DESIGNED FOR?

- Entrepreneurs and business owners

- Investors (business or individuals)

- High-income earners (W2 wages)

- Individuals paying six-figures in taxes annually

- Individuals with significant assets (estate worth $1M+)

- Individuals looking to sell an asset (business, investments, real estate)

- Professionals who work with all the above categories of individuals (attorneys, accountants, financial advisors, insurance agents, realtors, fund advisors or managers, trustees, etc.)

- Individuals and families looking into asset protection, tax reduction, and wealth preservation

WHO HOSTS THE WORKSHOPS?

TEDx Speaker, Legal Researcher, and Estate Attorney, Sid Peddinti, hosts the workshop, and invites other seasoned attorneys, accountants, trustees, investment advisors, insurance advisors, private fund managers, and several other professionals involved in the world of "law, tax, and finance" to share their insights and wisdom around these topics.

CAN I INVITE A BUSINESS PARTNER, FAMILY MEMBER, OR ADVISOR TO ATTEND THE WORKSHOP?

Yes - we encourage you to invite any of those individuals to attend the workshop and join the conversation. These topics are highly relevant if they are working with you and dealing with "law, tax, or financial" matters for you and your family.

We cover many different perspectives and strategic angles that could be relevant to the startegies that your business partners or advisors are working on - one small "strategic" move could end up saving you tens of thousands, perhaps even millions of dollars, over the course of several years or even on a single transfer.

These sessions are free - we are covering the cost of hosting these workshops, it does not cost YOU or YOUR advisors to attend these workshops and make valuable connections or leave with a new "legal or tax trick" that can be leveraged.

WHO ELSE ATTENDS THESE WORKSHOPS AND WILL I MEET NEW PEOPLE?

The list of individuals listed in FAQ 1 are the people who attend these workshops.

If you were invited to attend a workshop to arrive on this page through an advisor, consultant, or friend, there's a good chance that we've already spoken to them, gone through these "law, tax, and financial" conversations, and have decided to partner up or team up with their organization in one way or another.

Through strategic alliances and joint ventures, we have created one of the LARGEST networks of law, tax, and financial professionals in the world - we have a community of 5,000 investment advisors and insurance agents, 120 law firms, and 50 accounting firms in our network at this point in time - and expanding rapidly.

It's all about solving problems in a collaborative manner - all of us are in this together and what each of decide to implement WILL IN NO WAY SHAPE OF FORM IMPACT the strategies and taxes and goals of other members.

In simple terms, we are NOT in competition with each other - the court system and tax collection agencies do not look at what another member in this group is doing when evaluating and taxing YOUR ESTATE.

So, yes - the person who have invited you is one of our joint venture partners - we're all in this game of "life, death, and taxes" together!

Interactive Problem Solving

These workshops involve answering questions that you might be looking into getting solved

What exactly is estate planning, and why is it important for someone like me?

What you do now impacts your loved ones are your death - and the legal entities that you setup and leverage today will determine how assets are passed to the next generation during and after your death - it's all interconnected.

Estate planning is the process of "organizing, arranging, and strategically gifting" assets for the management and distribution of your assets after your death, in a way that reflects your wishes, protects your loved ones, and ensures you minimize all sorts of taxes that are involved in this "strategic transfer" of wealth.

I already have a will – isn't that enough?

Although a will plays a crucial role in estate planning, it alone may not offer the comprehensive safeguards and versatility you require. A will only takes effect after your passing and must undergo probate, a public process that can be time-consuming, costly, and open to scrutiny.

Conversely, a meticulously constructed estate plan can incorporate diverse instruments and approaches, such as trusts and foundations, enabling you to maintain greater command over your assets and mitigate tax burdens both during your lifetime and thereafter.

I'm interested in giving back to the community – how can I incorporate philanthropy into my estate plan?

Adopting a strategic approach to philanthropy presents a powerful avenue to leave an enduring legacy supporting the causes dear to your heart, while simultaneously optimizing tax advantages for you and your beneficiaries. By instituting a private foundation or donor-advised fund, you can implement a systematic framework for charitable contributions, benefit from immediate tax deductions on your donations, and engage your family in the decision-making process.

Our goal is to help you develop a detailed "Wills, Trusts, and Foundation Roadmap" that allows you to gain a holistic understanding of the entire process - which is essential for sound decision-making.

I've heard about trusts, but I'm not sure how they work or if they're right for me – can you explain?

Trusts are versatile legal tools that can serve a variety of purposes in estate planning, asset protection, and wealth transfer. Essentially, a trust is a legal arrangement in which one party (the grantor) transfers assets to another party (the trustee) to hold and manage for the benefit of a third party (the beneficiary).

Trusts can be used to minimize estate taxes, avoid probate, protect assets from creditors, and provide for the ongoing care and support of loved ones. Attend the free Hotline to learn more about trusts and some of the most popular questions around trust topics - it'll help you understand what's appropriate for your situation and how to go about structuring one or more trusts.

I'm concerned about the impact of taxes on my estate – what strategies are available to minimize tax liabilities?

Tax planning constitutes a pivotal component of estate planning for affluent individuals and those with substantial incomes. Fortunately, a diverse array of strategies exist to mitigate tax liabilities and maximize the value of your estate for your beneficiaries.

These may encompass gifting tactics, charitable contributions, life insurance trusts, and beyond. We have created multiple resources, blogs, videos, and webinars that explain these concepts in more depth, and host a free workshop where participants can ask questions as well.

We Explore Real Life Scenarios

Use legal and tax strategies to solve day-to-day and long-term problems

Scenario 1: You're a successful business owner with significant assets tied up in your company. You're concerned about protecting your wealth and minimizing tax liabilities for yourself and your heirs.

As a successful business owner with substantial company assets, you can develop strategies to protect your wealth and minimize taxes: business succession planning through tax-efficient ownership transfers; trusts like GRATs or IDGTs to transfer interests while saving taxes; and charitable planning with private foundations for deductions and family involvement.

Life insurance, asset protection vehicles like FLPs and complex trusts may also be beneficial.

Scenario 2: You've recently experienced a major life event, such as marriage, divorce, or the birth of a child, and you're unsure how these changes will impact your estate plan.

Significant life events necessitate revisiting your estate plan. For marriages, you can explore updating beneficiary designations, titling of assets, and potential trust structures.

Divorces require revising provisions, protecting separate property, and potentially establishing trusts.

With children, you may need to review guardian nominations, funding trusts for minors, and education planning strategies within your overall estate plan.

Scenario 3: You're nearing retirement age and are thinking about how to transition your business and assets to the next generation while also providing for your own financial security.

As you approach retirement, coordinated planning is key for a smooth business transition and ensuring your financial needs are met. We can explore tax-efficient ownership transfer strategies like intentionally defective grantor trusts or sale to an intentionally defective income trust. In rare situation, even donating a business to a private foundation, "The Paul Newman Way", could even be explored.

Properly structured buy-sell agreements and entity restructuring may facilitate passing your business interests.

Ensure to review your investment portfolio, income streams, and potentially a personal residence trust to support your retirement lifestyle while maximizing wealth transfer.

Scenario 4: You're passionate about giving back to the community and want to establish a legacy of philanthropy, but you're not sure where to start or how to maximize the impact of your charitable contributions.

Creating a strategic philanthropic plan allows you to support causes meaningful to you while maximizing tax benefits. Creating a private foundation or donor-advised fund providing an institutionalized vehicle and immediate tax deductions for contributions.

This enables family members to get engaged in investing and grant-making decisions to instill your values across multiple generations.

Tools like private foundations allow you to seamlessly integrate sophisticated investment strategies with philanthropic work in a structured and methodical manner, generation after generation.

Our mission is to help business owners, investors, and individuals with high-income and net worth strategically invest and donate through their private foundations and become purpose-driven leaders in their communities.

Join Us To Align Law, Tax, And Finance Strategies & Objectives

Book A Seat At The Law and Tax Workshop

A Complimentary Service Hosted By Law and Tax Foundation, A Nonprofit Organization On A Mission To Empower Entrepreneurs With Legal & Tax Strategies

Copyrighted Material © All Rights Reserved. 2024.

Law and Tax Workshops™ c/o Estate Law Training Center, a 501c3 Nonprofit Organization.

IMPORTANT: EARNINGS AND INCOME DISCLAIMER

The testimonials showcased on this page are authentic accounts from our clients. However, the outcomes depicted here are not typical and should not be construed as guarantees. Your personal results may differ depending on factors such as your skills, experience, level of motivation, and other unpredictable variables. Our company has not conducted comprehensive studies on the results of our average clients. Therefore, your outcomes may vary.